In today’s economy, every dollar saved counts. Prices for groceries, fashion, and even basic household needs have been rising steadily, pushing shoppers to look for smarter ways to stretch their money. That is where budget hacks CWBiancaMarket come into play. These aren’t just generic saving tips; they are targeted strategies designed to help you get the most value when shopping through CWBiancaMarket. From leveraging seasonal discounts to maximizing loyalty rewards, the right approach can turn everyday purchases into real long-term savings.

What is CWBiancaMarket?

CWBiancaMarket is an emerging retail marketplace that offers a wide range of products—from groceries and household essentials to clothing, electronics, and lifestyle items. What makes it stand out is its blend of affordability and variety, paired with frequent promotions, loyalty programs, and digital deals. For shoppers who know when and how to take advantage of these opportunities, CWBiancaMarket becomes more than just a store—it’s a savings platform.

Why “Budget Hacks” Matters

With inflation squeezing household budgets, it’s no longer enough to shop casually. Strategic shopping has become a financial survival skill. Budget hacks provide practical ways to:

- Cut unnecessary expenses without compromising quality.

- Plan purchases around CWBiancaMarket’s sale cycles to maximize discounts.

- Adopt smarter financial habits—from meal planning to coupon stacking—that translate into hundreds of dollars saved annually.

In short, budget hacks aren’t about being cheap; they’re about being efficient. They empower shoppers to maintain their lifestyle, shop smarter, and still keep more money in their pocket.

Set Your Budget and Financial Goals

Before diving into discounts and coupons, the first step is to build a budget framework that keeps your spending aligned with your financial goals. Without a plan, even the best deals at CWBiancaMarket can tempt you into overspending.

Tools and Mindset: The 50/30/20 Rule

A proven way to structure your finances is the 50/30/20 rule. Here’s how it works:

- 50% Needs – Essentials like groceries, rent, utilities, and transportation. CWBiancaMarket groceries and household items fall into this category.

- 30% Wants – Non-essentials like fashion, beauty, and lifestyle products. With CWBiancaMarket’s seasonal sales, you can enjoy these luxuries without breaking the bank.

- 20% Savings/Debt Repayment – Building your emergency fund, paying off credit cards, or investing.

This rule provides balance, ensuring you’re not overspending in one category while neglecting another. It’s simple, flexible, and widely recommended by personal finance experts.

Budgeting Apps to Keep You on Track

Modern tools make budgeting far easier than spreadsheets alone. Popular apps include:

- YNAB (You Need A Budget): Helps you assign every dollar a “job” and track spending in real time.

- PocketGuard: Connects to your accounts and shows how much “free money” you actually have after bills and savings goals.

- Mint or Growth Navigate’s recommended trackers: Useful for automated expense categorization and visual insights.

By combining these apps with CWBiancaMarket’s digital coupons and loyalty alerts, you create a system where every purchase is intentional and measured.

Shoppers who track their expenses daily report saving hundreds each month. When you know exactly how much you can spend before you open the CWBiancaMarket app or step into the store, you shift from reactive spending to strategic saving. This mindset turns budget hacks into long-term financial progress.

Smart Shopping Tricks

Shoppers at CWBiancaMarket can unlock significant savings by combining digital tools, timing strategies, and smart purchasing habits. The goal isn’t just to buy cheaper—it’s to maximize every dollar spent through careful planning.

Coupon Stacking and Navigating Digital Deals

One of the most effective tricks is coupon stacking—using multiple discounts on a single purchase. At CWBiancaMarket, this can be done in three layers:

- Store Coupons: Available through newsletters, the official app, or CWBiancaMarket.com.

- Manufacturer Coupons: Discounts provided directly from brands that CWBiancaMarket carries.

- Promo Codes & Loyalty Points: Often shared during special campaigns or unlocked by joining the loyalty program.

When stacked together, a $20 purchase could shrink to $10 or less. For example, pairing a $5 manufacturer coupon with a 20% store promo code and loyalty credits results in dramatic savings. StartUpBooted and GrowthScribe both highlight this strategy as one of the most underused yet most rewarding hacks for regular shoppers.

Pro tip: leave items in your cart online for 24 hours—CWBiancaMarket sometimes responds with an extra discount code to encourage checkout.

Sales Timing Strategies—Seasonal, Flash, and Weekly Cycles

Timing is everything when it comes to savings. GrowthScribe emphasizes that CWBiancaMarket’s biggest deals follow predictable cycles:

- Seasonal Clearances: End-of-summer, fall, winter, and spring cleanouts bring 30–60% markdowns on apparel, home goods, and electronics.

- Flash Sales & Holiday Promotions: Limited-time events, especially around Black Friday, New Year, and mid-summer clearance, offer steep discounts.

- Weekly Patterns: New deals often drop midweek—Wednesday restocks are prime time for fresh stock and lower competition.

- Mid-Month Promotions: Around the 15th, CWBiancaMarket regularly runs loyalty bonuses and bundle offers.

By creating a shopping calendar that marks these cycles, you avoid impulse buying and instead align your purchases with the lowest price windows. StartUpBooted confirms that shoppers who align with weekly and seasonal cycles cut their expenses by up to 25–30%.

Without strategy, you might pay full price for items that drop in cost within days. With smart shopping tricks—stacking coupons, leveraging loyalty rewards, and aligning purchases to the right timing—you ensure that CWBiancaMarket becomes a consistent source of value, not just convenience.

Maximize Tools & Rewards

Shopping smart at CWBiancaMarket isn’t only about timing your purchases—it’s also about knowing which tools and reward systems work in your favor. By tapping into loyalty programs, newsletters, app alerts, and cashback platforms, you can stretch every dollar even further.

Loyalty Programs, Newsletters, and App Alerts

CWBiancaMarket’s loyalty program is one of the easiest ways to accumulate steady savings. Members often receive:

- Exclusive Discounts: Prices that aren’t available to non-members.

- Point Accumulation: Every purchase earns credits that can be redeemed later.

- Birthday and Seasonal Rewards: Surprise coupons during special occasions.

Startup Booted and GrowthScribe highlight that simply joining the loyalty program can cut 5–10% off an annual shopping budget. Pair this with the store’s newsletter and mobile app alerts, and you’ll be the first to know about flash sales, digital coupons, and cart abandonment incentives. CWBiancaMarket.com itself notes that app users frequently receive early-access deals that aren’t advertised widely.

Pro tip: Enable push notifications in the app so you never miss a limited-time promotion—many deals last only a few hours.

Cashback Integrations and Rebate Apps

Beyond store-driven rewards, cashback apps like Ibotta, Rakuten, or Honey can be linked with CWBiancaMarket purchases for extra layers of savings. Growth Navigate reports that shoppers using rebate apps consistently recover 3–10% of their spending each month.

Here’s how to maximize this stack:

- Start with a loyalty discount or coupon at checkout.

- Pay using a rewards credit card to earn points or cash back.

- Claim a rebate from Ibotta or Rakuten on eligible items.

Example: A $100 grocery haul could drop to $85 after a store promo, then return another $5–$7 in cashback—effectively reducing the cost to $78–$80. Over a year, these layered savings easily add up to hundreds of dollars.

Most shoppers stop at store coupons, leaving cashback and rebate opportunities unused. By combining CWBiancaMarket’s in-house rewards with external apps, you build a multi-channel savings system. Every purchase becomes a small win toward your larger financial goals.

Meal Planning & Pantry Management

Budget hacks at CWBiancaMarket go beyond finding discounts—they also involve using what you buy strategically. A well-planned approach to meals and pantry organization ensures that savings from coupons and sales don’t disappear through waste or last-minute expensive takeout.

Align Meals with Sales

Startup Booted emphasizes that planning meals around CWBiancaMarket’s weekly deals can cut grocery expenses by 20–30%. Instead of planning recipes first and shopping later, reverse the process:

- Check the weekly ad or app alerts to see which proteins, produce, or pantry items are discounted.

- Build a flexible menu (for example, tacos if ground beef is on sale, or pasta dishes if tomato products are discounted).

- Batch cook and freeze portions to save both money and time on busy nights.

This simple shift ensures your meals naturally adapt to price drops, maximizing the impact of store promotions.

Stock Up Strategically

Buying in bulk only makes sense if it saves money and you actually use the items. At CWBiancaMarket, staples like rice, pasta, canned goods, and frozen vegetables are often offered in larger quantities at significantly lower per-unit prices. The key is:

- Focus on non-perishables or items that freeze well.

- Watch for bundle deals that combine everyday essentials.

- Store properly (airtight containers, freezer bags) to prevent spoilage.

Strategic stock-ups transform flash sales into year-round savings.

Pantry Challenges

One of the most underrated budget hacks is the pantry challenge—a commitment to cook meals using only what’s already in your pantry or freezer for a set period (like one week each month). Startup Booted notes that these challenges help reduce waste while lowering grocery bills. A family might discover forgotten cans of beans or pasta packs and turn them into full meals instead of letting them expire.

Meal planning and pantry management convert shopping tricks into sustainable household habits. Instead of chasing deals randomly, you build a rhythm: shop sales, plan meals accordingly, store efficiently, and cycle through pantry stock. The result isn’t just short-term savings—it’s a long-term system that keeps your food budget under control.

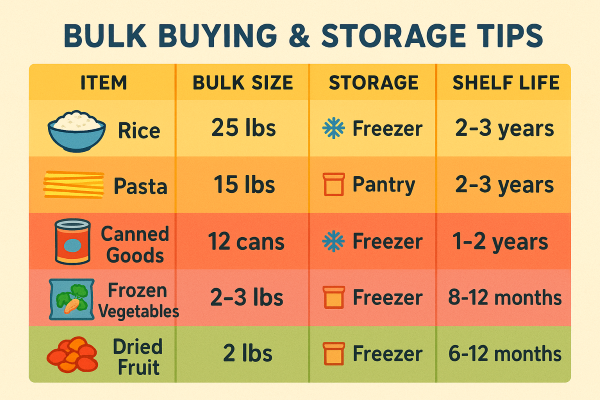

Bulk Buying & Storage Tips

Another essential strategy for budget hacks CWBiancaMarket is buying in bulk and storing items properly. When executed correctly, bulk buying can dramatically lower your per-unit cost and reduce the number of shopping trips, saving both time and money.

Benefits of Non-Perishables

Non-perishable items like rice, pasta, canned vegetables, beans, and cooking oils are ideal for bulk purchases. Startup Booted highlights several advantages:

- Lower Cost per Unit: Larger packages typically cost less per ounce or pound than smaller ones.

- Reduced Shopping Frequency: Stocking up on essentials means fewer trips to the store, saving on transportation and impulse purchases.

- Emergency Preparedness: Having a well-stocked pantry ensures you can maintain meals even during unexpected situations or busy weeks.

Group Discounts & Shared Buying

Another smart tactic is group buying, where families, friends, or neighbors pool resources to buy large quantities. CWBiancaMarket sometimes offers discounts for multiple-unit purchases. Splitting bulk items with others not only reduces individual cost but also prevents waste. For example, buying a 10-pack of canned tomatoes and sharing with a friend can cut costs while still providing pantry variety.

Freezing & Storage Tips

Perishables like meats, bread, and fresh vegetables can also be purchased in bulk if stored properly. Effective freezing and storage tips include:

- Labeling and Dating: Mark all items with purchase and freeze dates to track freshness.

- Portion Control: Freeze in meal-sized portions to reduce waste.

- Vacuum Sealing or Airtight Containers: Extends shelf life and prevents freezer burn.

With the right storage techniques, even items that normally spoil quickly can become long-term savings assets.

Bulk buying combined with proper storage turns occasional sales into long-term value. By planning purchases and storing items smartly, shoppers at CWBiancaMarket can reduce per-unit costs, prevent waste, and create a reliable supply of essentials—all of which contribute to a more sustainable and effective budget strategy.

Success Stories & Motivation

Understanding budget hacks CWBiancaMarket is one thing, but seeing real-life results can be incredibly motivating. Many shoppers have transformed their spending habits and achieved significant savings through consistent application of smart strategies.

Startup Booted and Growth Navigate report that disciplined use of CWBiancaMarket hacks—like coupon stacking, timing purchases, and meal planning—can lead to remarkable savings:

- $500 per month: Families who align weekly meals with store promotions and leverage loyalty rewards often see grocery bills drop by hundreds each month.

- $1,500 per year: For smaller households or single shoppers, careful budgeting combined with cashback apps and digital deals can accumulate into substantial annual savings.

These numbers demonstrate that even small, consistent actions—like tracking weekly discounts or freezing bulk items—can compound into meaningful financial relief over time.

Mindful Habits and Behavior Change

Savings aren’t just about the numbers—they’re about mindset. Growth Navigate and Management Works Media highlight the importance of mindful spending habits:

- Track Every Purchase: Maintaining a daily or weekly log helps identify unnecessary spending and areas for improvement.

- Set Realistic Goals: Break down large savings targets into manageable milestones to avoid feeling overwhelmed.

- Reward Yourself Strategically: Celebrate small wins to reinforce positive financial behavior without overspending.

- Reflect and Adjust: Review spending patterns regularly and tweak strategies based on results.

Seeing examples of real savings reinforces that budget hacks aren’t theoretical—they work. Shoppers are more likely to stay motivated when they witness tangible results, learn from others’ successes, and understand that small behavior changes can lead to lasting financial benefits.

Conclusion

Mastering budget hacks CWBiancaMarket isn’t about being perfect—it’s about consistency. Even small, regular actions like checking weekly deals, stacking a coupon, or planning one extra meal in advance can accumulate into significant savings over time. The key is to start somewhere and stick with it, rather than trying to implement every strategy at once.

For readers ready to take control of their finances, the best approach is simple: pick one hack at a time. Maybe begin with signing up for the CWBiancaMarket loyalty program, or start tracking your grocery spending with a budgeting app. Once that habit becomes routine, layer in another strategy, like meal planning or cashback apps.

By taking gradual, deliberate steps, you’ll build a sustainable system that not only reduces costs but also encourages mindful spending and financial confidence. Remember, the goal isn’t a perfect month—it’s steady progress that adds up to real, measurable savings.

Final Thought: Start today. Choose one CWBiancaMarket hack, apply it consistently, and watch how small changes transform your shopping habits—and your wallet—over the coming weeks.

Frequently Asked Questions

Q1: How do I stack coupons at CWBiancaMarket?

Start by combining three types of discounts:

- Store coupons from newsletters or the CWBiancaMarket app.

- Manufacturer coupons provided by brands for eligible products.

- Promo codes or loyalty points earned through membership programs.

Stacking these together allows you to maximize savings on a single purchase. Always check the store’s coupon policy to avoid conflicts or exclusions.

Q2: When are the best times to shop for deals?

CWBiancaMarket follows predictable discount cycles:

- Seasonal clearances: End-of-summer, fall, winter, and spring.

- Weekly deals: New promotions often drop midweek (Wednesday restocks are ideal).

- Mid-month promotions: Around the 15th, loyalty bonuses and flash deals are common.

Planning your shopping around these windows ensures you buy items at their lowest prices.

Q3: Can cashback apps be combined with CWBiancaMarket discounts?

Yes! Using apps like Ibotta, Rakuten, or Honey along with store coupons and loyalty rewards can create a layered savings effect. Always check eligible items and follow app instructions for claiming rebates.

Q4: How can I reduce food waste while saving?

Meal planning around weekly ads, freezing surplus items, and using a pantry challenge are effective strategies. Batch cooking and portioning meals before freezing also prevent spoilage while keeping costs low.

Q5: What should I avoid when applying these hacks?

Avoid impulse purchases, coupon misuse, and ignoring expiration dates. Ethical shopping ensures long-term access to deals and protects your budget.

Q6: Are there apps that help track my savings?

Yes—budgeting apps like YNAB, PocketGuard, and Mint can track expenses, monitor savings progress, and visualize how much you’re saving through CWBiancaMarket hacks.