In the UK, taxes and finances are closely linked, and at the centre of this connection is HMRC. HMRC, also known as Her Majesty’s Revenue and Customs, is the government body that manages tax collection, compliance, and enforcement. For every taxpayer, understanding how HMRC tax bank accounts work together is important. Your bank account is not only a place to store money but also a record of your financial activity. HMRC can use this information to check whether you are paying the right amount of tax. This makes it necessary for individuals, businesses, and even those with overseas accounts to know the rules.

Bank accounts play a big role in how HMRC tracks income. Interest earned on savings, large cash deposits, business transactions, and even foreign account activity can be reviewed by HMRC. Many people believe that their bank information stays private, but in reality, banks are legally required to share certain details with HMRC when asked. This helps HMRC confirm that income, savings, and investments are declared correctly. As a result, HMRC tax and bank accounts are strongly connected, and this connection affects everyone from employees to self-employed professionals.

This topic is especially important for UK taxpayers today because tax rules are becoming more strict. HMRC now works with banks both inside the UK and abroad under global information-sharing agreements. This means hiding money or forgetting to declare income is harder than ever before. By learning how HMRC tax and bank accounts link together, you can avoid penalties, manage your money better, and stay fully compliant. A clear understanding of these rules not only protects you from fines but also builds peace of mind when dealing with your finances.

What is HMRC?

HMRC stands for Her Majesty’s Revenue and Customs. It is the UK’s official tax authority, created to handle everything related to taxes, national insurance, and customs. HMRC makes sure that people and businesses pay the right amount of tax on time. It also deals with VAT, corporation tax, income tax, and capital gains tax. Beyond that, HMRC is responsible for tax credits, child benefits, and even enforcing the minimum wage. In short, HMRC manages a wide range of financial matters that affect almost every person living or working in the UK.

The link between HMRC tax bank accounts is a natural part of its job. HMRC uses bank account data to confirm income, savings, and investments. This is not just about catching tax evasion, but also about ensuring fairness. When everyone pays their fair share, the government can fund public services like healthcare, education, and infrastructure. HMRC collects billions every year, and much of this depends on accurate reporting of bank transactions. By monitoring accounts, HMRC makes sure the tax system works fairly for all taxpayers.

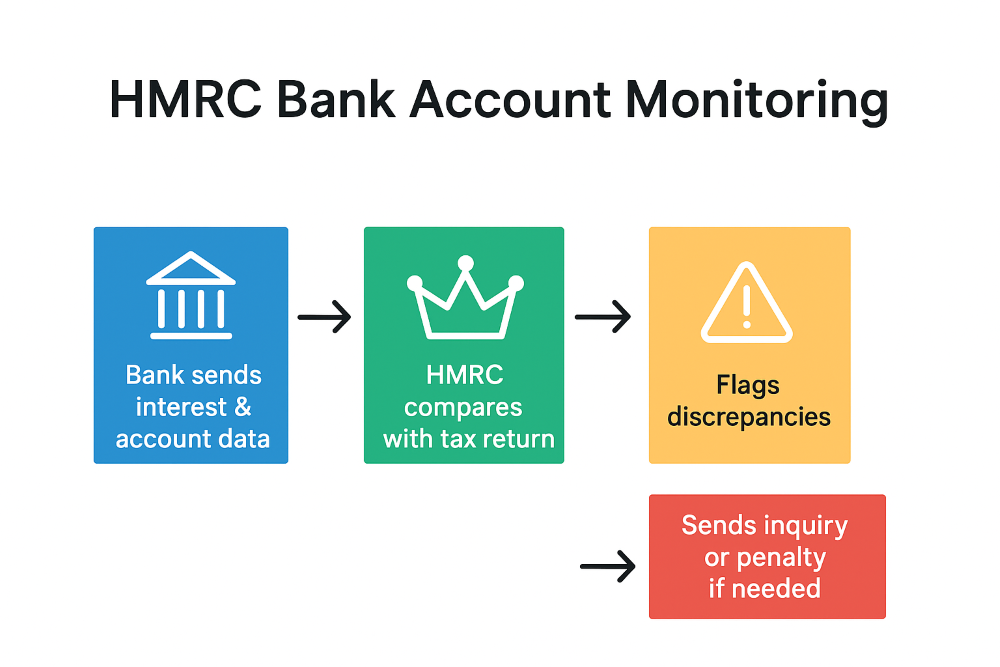

HMRC is also becoming more modern and digital. It uses advanced systems to match bank account records with tax returns. If there is a mismatch, HMRC can flag the account for review. For example, if your savings interest is reported by the bank but not included in your tax return, HMRC will notice. This digital approach shows why understanding HMRC tax and bank accounts is essential. Knowing how HMRC works, and why it checks bank accounts, helps you manage your money better and avoid unnecessary problems.

Can HMRC Access Your Bank Account?

Many UK taxpayers often ask whether HMRC can look directly into their bank accounts. The answer is yes, but with certain rules. HMRC does not have free and unlimited access to your money. However, it has legal powers to request details from banks and other financial institutions. This means that if HMRC suspects undeclared income, tax evasion, or irregular activity, they can ask your bank for information. By law, banks must provide this information when requested. So while HMRC cannot see every small detail instantly, they can step in whenever they need to investigate your financial activity.

The connection between HMRC tax and bank accounts is stronger than ever. Today, banks automatically share savings interest details with HMRC. This makes it easier for HMRC to check whether you are paying the correct tax on your earnings. In some cases, HMRC may also run random compliance checks. These are carried out even if you are not under suspicion, just to make sure the system is fair and transparent. If HMRC notices unusual deposits, regular cash payments, or income that does not match your declared salary, they may open an inquiry.

For UK taxpayers, this means being open and honest with HMRC is the safest path. If your tax return matches your bank records, you have nothing to worry about. But if there are hidden earnings or undeclared savings, HMRC will likely find them. With modern systems, global agreements, and data-sharing tools, it has become much easier for HMRC to access information when needed. Knowing this helps you understand why your bank account is more than just a financial tool—it is also a record that HMRC can use to ensure full compliance with tax rules.

How HMRC Tax Bank Account Uses Information

HMRC uses bank account data to make sure people are paying the correct amount of tax. One of the most common checks is on savings interest. Banks now report interest directly to HMRC. If the interest you earn is higher than your personal savings allowance, HMRC will adjust your tax calculation. This way, taxpayers do not need to manually report every detail, but HMRC still knows how much income is coming from bank accounts.

Bank accounts also help HMRC find undeclared earnings. If someone earns cash from side jobs, freelance work, or business sales and deposits it into their account without reporting it, HMRC may spot the difference. Regular payments, large deposits, or income patterns that do not match your tax return can trigger an investigation. HMRC compares what you declare with what the bank records show. If the numbers do not match, HMRC will ask questions.

Another important role is tracking overseas accounts. Through global data-sharing agreements, HMRC receives details about foreign bank accounts held by UK residents. This means income from abroad, such as rental earnings, dividends, or savings interest, cannot easily be hidden. HMRC tax and bank accounts are connected both inside the UK and across borders. This makes it very important for taxpayers to declare all sources of income, whether local or international. By using bank account information, HMRC ensures fairness and prevents tax evasion, while honest taxpayers stay safe from penalties.

Tax on Bank Interest and Savings

When you earn interest from your savings or bank deposits in the UK, it counts as taxable income. HMRC keeps a close link between tax and bank accounts to make sure savings interest is declared correctly. Since 2016, most banks and building societies automatically report interest payments to HMRC. This means your tax account is updated without you needing to send extra forms. For many taxpayers, the system is simple because HMRC already knows how much interest you earned during the year.

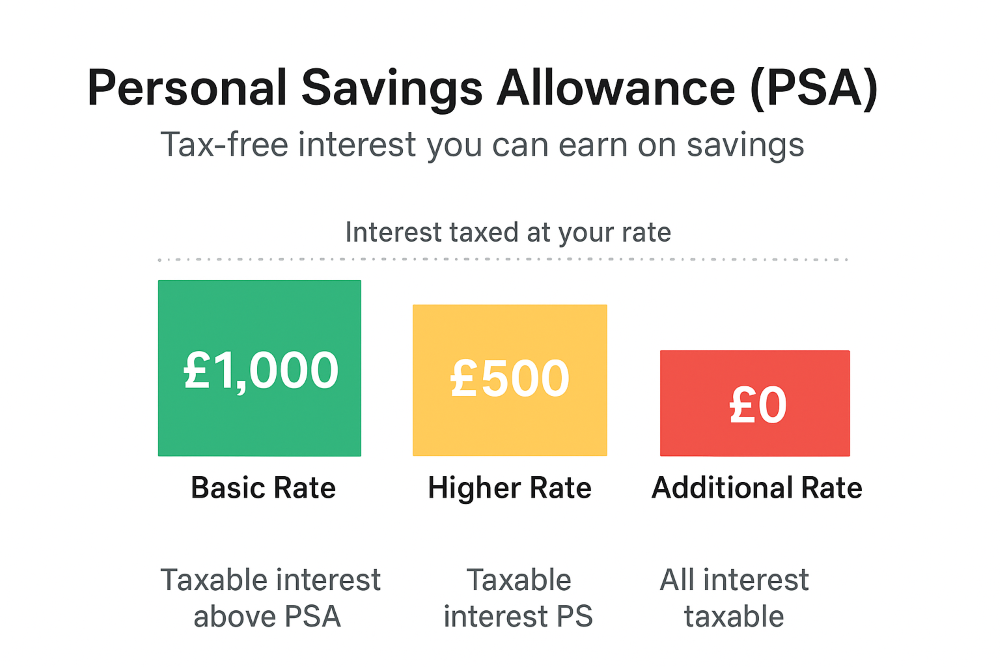

The good news is that not all savings interest is taxable, thanks to the Personal Savings Allowance (PSA). If you are a basic rate taxpayer, you can earn up to £1,000 in interest each year without paying tax. Higher rate taxpayers can earn up to £500 tax-free, while additional rate taxpayers do not receive any allowance. If your interest goes above these limits, HMRC will collect tax through your self-assessment return or by adjusting your PAYE tax code. This way, HMRC ensures that everyone pays the right amount based on their income level.

For UK taxpayers, it is important to understand that HMRC savings rules cover all types of accounts, including current accounts, savings accounts, and ISAs. While ISAs remain tax-free, other accounts must be declared if they produce taxable interest. Ignoring this can create problems later, as HMRC already receives this information from banks. To stay compliant, you should always check your annual savings statements and compare them with your tax return. By doing this, you make sure your HMRC tax and bank accounts are in line and avoid unnecessary penalties.

Overseas Bank Accounts and HMRC Rules

Many UK taxpayers hold money abroad, either for savings, property income, or investments. What some people do not realise is that HMRC requires all UK residents to declare foreign income. This includes interest from overseas bank accounts, rental income from foreign properties, and dividends from international investments. If you live in the UK for tax purposes, HMRC expects you to report this income in your tax return. The link between HMRC tax and overseas accounts is now stronger than ever before.

This is because the UK takes part in the Common Reporting Standard (CRS). Under this global agreement, more than 100 countries share banking details with each other. This means if you have a bank account in another country, HMRC can still see the information. Hiding income abroad is no longer easy, as HMRC automatically receives data about balances, interest, and account ownership. If you fail to report this, you may face penalties, backdated tax bills, or even legal action.

The safest approach for UK taxpayers is to be transparent. If you have foreign bank accounts, declare them and include the income in your tax return. HMRC also offers disclosure facilities for those who forgot to declare in the past. By coming forward voluntarily, penalties are reduced, and legal risks are avoided. With CRS in place, HMRC overseas account checks are very detailed, so full honesty is the only secure path. This way, you keep your finances safe and stay compliant with tax law.

Large Cash Deposits and HMRC Scrutiny

Large cash deposits in your bank account can attract attention from HMRC. While depositing cash is not illegal, frequent or unusually large amounts may trigger an inquiry. HMRC monitors accounts to ensure all money matches declared income. If the source of cash is unclear or inconsistent with your tax return, HMRC may investigate further. This makes it important for UK taxpayers to keep records of significant deposits.

Cash from sales, gifts, or inheritance should always be documented. Even if the money is legitimately yours, HMRC may ask for proof during a compliance check. The connection between HMRC tax and bank accounts means that banks can report large transactions. HMRC uses this data to identify discrepancies and prevent tax evasion. Being proactive with records helps avoid unnecessary stress and penalties.

Business owners and self-employed individuals should be especially careful. Cash payments from clients should be recorded accurately. Mixing personal and business cash can complicate matters and raise red flags with HMRC. By keeping clear records and declaring all cash income, you ensure your bank accounts stay compliant with HMRC rules. Proper documentation is a key step to staying safe and avoiding penalties.

Business Bank Accounts and Tax Compliance

For business owners and self-employed individuals, keeping a separate bank account is essential. Mixing personal and business finances can create confusion and make it harder to prove income. HMRC pays close attention to business bank accounts to ensure that income, expenses, and VAT are recorded correctly. By keeping a dedicated business account, you simplify accounting and reduce the risk of errors in your tax return.

HMRC tax bank accounts for businesses also involve reporting. Banks may share information on transactions if HMRC requests it during an audit. This includes income from clients, expenses, and large transfers. Accurate record-keeping helps you provide evidence for all transactions and avoid penalties. It also makes it easier to calculate tax on profits and ensure VAT payments are correct.

For self-employed taxpayers, digital record systems and accounting software can make compliance easier. Keeping receipts, invoices, and bank statements together ensures transparency. If HMRC reviews your account, you can demonstrate that all income is declared and all expenses are legitimate. By maintaining clear business bank accounts, you stay fully compliant with UK tax laws and protect yourself from unnecessary fines or legal issues.

HMRC Penalties for Non-Compliance

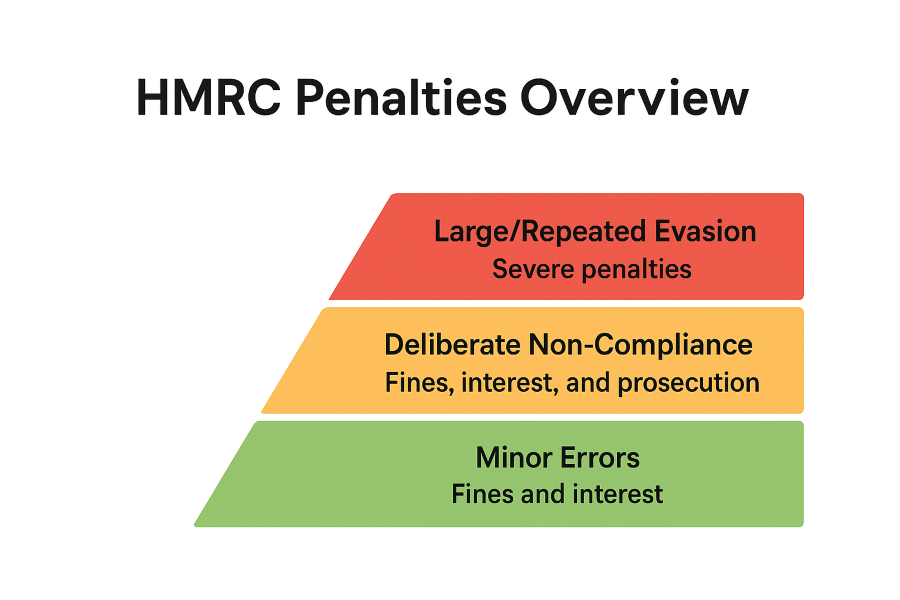

Failing to declare income or hiding money in bank accounts can lead to serious consequences. HMRC has strict rules, and penalties depend on the severity of the issue. If your tax return does not match your bank account records, HMRC may issue fines, charge interest on unpaid taxes, or even open a criminal investigation in extreme cases. The connection between HMRC tax and bank accounts ensures that undeclared income is more likely to be detected today than ever before.

Penalties can include backdated tax bills for missed payments. For minor errors, HMRC may offer a warning or a small fine. For deliberate non-compliance, fines can reach up to 200% of the unpaid tax. Interest on late payments is calculated daily until the full amount is paid. This applies to income from savings, cash deposits, overseas accounts, and business earnings. Ignoring tax obligations can become expensive very quickly.

The best way to avoid penalties is transparency. Declare all income, report foreign accounts, and keep accurate records. HMRC also offers disclosure programs for taxpayers who forgot to declare past income. Voluntarily coming forward reduces penalties and avoids legal trouble. Understanding HMRC tax and bank accounts and staying compliant protects you from fines and builds confidence in managing finances.

How to Stay Safe and Compliant with HMRC

Staying safe and compliant with HMRC starts with honesty. Always declare all sources of income, including savings interest, freelance work, rental income, and overseas earnings. Your bank account shows a clear record of money flowing in and out. HMRC uses this information to check that your tax return matches reality. By keeping your declarations accurate, you avoid unnecessary penalties and audits. The connection between HMRC tax and bank accounts makes transparency the most important rule for every taxpayer.

Record-keeping is another key step. Keep bank statements, invoices, receipts, and proof of large deposits. This applies to both personal and business accounts. If HMRC ever questions your income or transactions, having clear records makes it easy to respond. For business owners, separating personal and business bank accounts is essential. It prevents confusion and makes accounting easier. Accurate records help HMRC see that your tax return is correct and reduce the chance of penalties.

Using digital tools can also make compliance easier. Accounting software, online banking summaries, and automated tax calculators help track income and expenses. For self-employed taxpayers, keeping digital copies of invoices and receipts ensures all business transactions are documented. HMRC also accepts electronic submissions, making reporting simpler and faster. By staying organized, you make sure that your HMRC tax and bank accounts remain fully compliant.

Finally, if you realize you forgot to report income, do not panic. HMRC provides disclosure schemes like the Worldwide Disclosure Facility and Digital Disclosure Service. By voluntarily reporting undeclared income, you can reduce penalties and interest. Taking prompt action shows HMRC that you are acting in good faith. Staying informed, organized, and transparent is the safest way to manage your finances. It ensures your bank accounts and taxes are in full compliance with UK law and protects you from future problems.

Conclusion

Understanding the link between HMRC tax and bank accounts is essential for every UK taxpayer. Your bank account is not just a place to store money; it is a record that HMRC can use to check your income, savings, and financial activity. By knowing how HMRC monitors accounts, you can stay compliant, avoid penalties, and manage your finances with confidence. Whether you earn a salary, run a business, or have overseas accounts, transparency is the key to staying safe.

HMRC now has access to a wide range of financial information, both in the UK and abroad. Banks report savings interest, large cash deposits may be scrutinized, and overseas accounts are tracked through international agreements. Understanding these rules helps you avoid mistakes. Keeping accurate records, separating personal and business finances, and declaring all income ensures that your bank accounts remain in line with HMRC rules. This approach protects you from fines, interest charges, and potential legal action.

In summary, staying compliant with HMRC is about honesty, organization, and awareness. By following UK tax rules, reporting all income, and using available tools, you can confidently manage your finances. The connection between HMRC tax and bank accounts may seem strict, but it exists to ensure fairness in the system. By understanding and following these rules, you secure your financial future and avoid unnecessary stress.

Frequently Asked Questions

1. Can HMRC see my bank account details?

Yes, HMRC can access your bank account information if they need to verify your income or investigate tax compliance. Banks are legally required to provide details when requested. This includes information on savings interest, large deposits, or unusual transactions. By reviewing these records, HMRC ensures that all income is declared and that taxpayers follow UK tax rules.

2. Do I have to declare interest from my bank account to HMRC?

Yes, interest from savings and other accounts is considered taxable income. However, most banks report savings interest directly to HMRC. Basic rate taxpayers have a Personal Savings Allowance (PSA) of £1,000, while higher rate taxpayers have £500. If your interest exceeds these limits, it must be declared in your tax return, or HMRC will adjust your tax accordingly.

3. How does HMRC check overseas bank accounts?

HMRC receives information about foreign bank accounts through international agreements like the Common Reporting Standard (CRS). This includes details about account balances, interest, and ownership. UK residents must declare all income from overseas accounts. Failure to do so can result in penalties, backdated tax bills, or legal action. Voluntary disclosure reduces fines and demonstrates compliance.

4. What happens if HMRC finds undeclared income in my bank account?

If HMRC identifies undeclared income, you may face fines, interest on unpaid taxes, and, in severe cases, prosecution. Penalties can reach up to 200% of the unpaid tax for deliberate non-compliance. HMRC will also require you to pay any backdated taxes. Keeping accurate records and reporting all income ensures that your bank accounts and taxes remain compliant.

5. Should I keep separate business and personal bank accounts?

Yes, separating business and personal accounts is essential for self-employed individuals and business owners. It simplifies record-keeping, makes it easier to calculate taxes, and reduces the risk of errors during an HMRC audit. Mixing accounts can lead to questions about undeclared income and increase the chance of penalties.

6. How can I stay safe and compliant with HMRC?

To stay compliant, always declare all sources of income, including bank interest, cash deposits, and overseas earnings. Keep accurate records of transactions, invoices, and receipts. Use a separate account for business income if self-employed. If you discover undeclared income, use HMRC’s disclosure schemes to report it voluntarily. Staying transparent, organized, and informed protects you from penalties and ensures your finances are fully compliant.