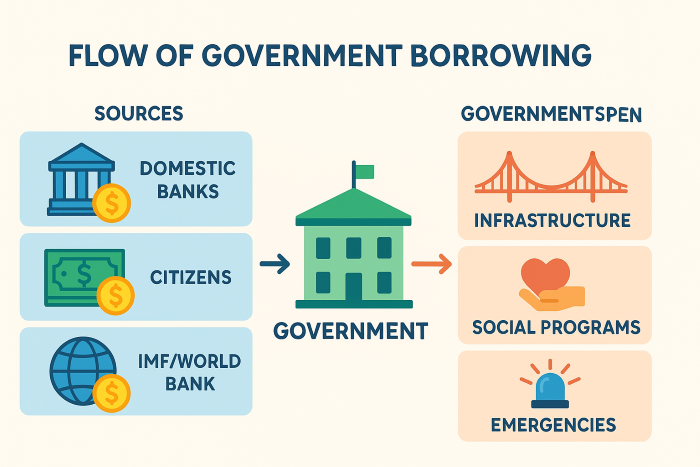

Government borrowing is the way a state raises money when its income is not enough to cover expenses. Almost every country in the world depends on borrowing because tax revenue and other sources of income often fall short. When this happens, governments use tools like issuing bonds, taking domestic loans, or seeking external loans from institutions such as the IMF and World Bank. This process is also called public debt or national debt, and it plays a major role in fiscal policy. Through borrowing, governments manage budget deficits, support economic growth, and handle sudden financial needs.

In simple terms, government borrowing is a bridge between limited revenue and growing expenditure. Countries borrow to fund infrastructure, pay for social programs, or stabilize their economies in times of crisis. For example, during wars, pandemics, or natural disasters, borrowing becomes a lifeline that ensures the government can continue to provide services. Developing countries often rely on external borrowing for large-scale projects like energy, transport, and education. On the other hand, developed countries issue treasury bonds and securities to maintain stability. In both cases, borrowing is a double-edged sword: it can create growth if managed wisely or lead to a debt trap if misused.

Government borrowing is not just an economic term; it is a reality that affects the daily lives of citizens. When borrowing is done for productive purposes, it creates jobs, improves infrastructure, and builds a stronger future. But excessive borrowing leads to higher taxes, inflation, and dependence on foreign lenders. That is why responsible borrowing is important for every nation. It must be balanced with strong revenue collection, transparent spending, and sustainable repayment plans. Understanding government borrowing helps us see how states manage money, how fiscal deficits are controlled, and why debt can both help and harm an economy.

What is Government Borrowing?

Government borrowing means the process through which a state raises money when its income is not enough to meet expenses. Every government collects revenue through taxes, duties, and fees, but this income is often smaller than what is needed to run the country. To cover this gap, the government borrows money from different sources. This practice is also called public debt or national debt, and it has become an important part of modern economies.

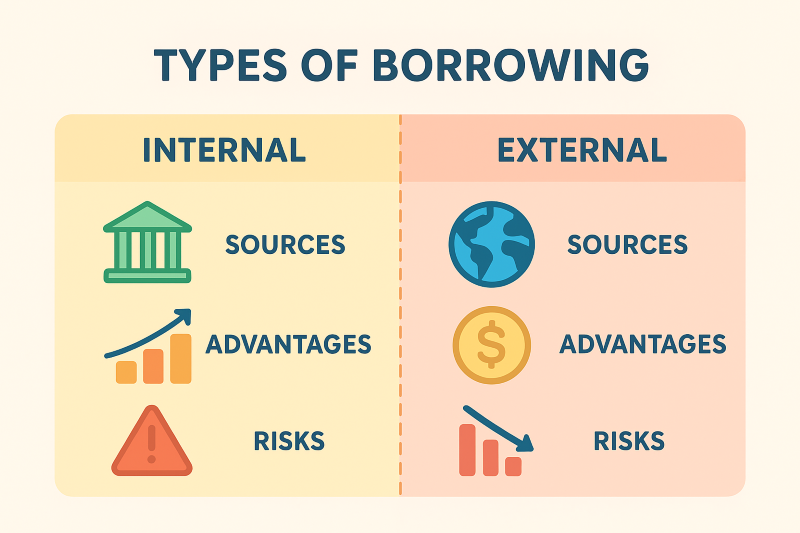

Borrowing can be done in two major ways: from domestic sources or from external sources. Domestic borrowing comes from within the country, such as loans from local banks, the central bank, or by selling government bonds to citizens and institutions. External borrowing, on the other hand, comes from outside the country, usually through loans from international lenders like the International Monetary Fund (IMF), the World Bank, or from other countries. Both types have their own advantages and risks, and governments often use a mix of the two.

The main purpose of government borrowing is to bridge the gap between limited revenue and rising expenditures. For example, when a country faces a budget deficit, it borrows money to pay for projects and services like building roads, hospitals, and schools. Borrowing also helps governments handle emergencies such as wars, natural disasters, or economic slowdowns. In some cases, countries even borrow money to repay older loans, which is called debt servicing.

Government borrowing is not always negative. If used wisely, it can help a country grow faster, create jobs, and improve living standards. But if borrowing becomes too high, it can lead to a debt trap, higher taxes, inflation, and pressure on the national currency. This is why borrowing must be managed carefully through strong fiscal policy, transparent use of funds, and proper planning for repayment.

Types of Government Borrowing

Government borrowing is not a single process. It can happen through different channels, and each type has its own impact on the economy. Broadly, there are two main types of government borrowing: internal borrowing and external borrowing. Both serve the same purpose of filling the gap between income and expenditure, but the way they work is different.

Internal Borrowing

Internal borrowing means taking loans from within the country. The government raises money from local banks, the central bank, financial institutions, and even citizens. One of the most common tools is the sale of government bonds or treasury bills. When people or institutions buy these bonds, they are actually lending money to the government in return for future repayment with interest.

The advantage of internal borrowing is that money stays inside the national economy. It encourages savings and investment, and it can also build trust among citizens who invest in government securities. However, too much internal borrowing can reduce the availability of credit for the private sector. This may hurt business activity and slow down economic growth. In addition, if the government borrows heavily from the central bank, it may lead to inflation because more money is printed to cover the debt.

External Borrowing

External borrowing means taking loans from foreign sources. These sources include foreign governments, international banks, and global financial institutions like the IMF, World Bank, or the Asian Development Bank. External borrowing provides access to foreign currency, which is useful for importing goods, paying for oil, or investing in large-scale infrastructure projects that require international funding.

The advantage of external borrowing is that it brings new resources into the country and helps finance projects that might not be possible with domestic funds alone. Many developing countries depend on external loans to build power plants, highways, and education systems. However, external borrowing also carries serious risks. A country becomes dependent on global lenders, and if repayment becomes difficult, it can face strict conditions or austerity measures. Heavy external debt may also weaken the national currency and put pressure on foreign reserves.

Why Do Governments Borrow?

Governments borrow money because their expenses are often higher than their income. Tax revenue and other earnings are not always enough to cover the costs of running a country. Borrowing becomes a way to fill this gap and keep the system working. But borrowing is not only for survival; it also helps governments invest in growth, protect citizens, and prepare for the future.

One of the main reasons for government borrowing is the budget deficit. When spending is greater than income, the government has no choice but to borrow. This money is then used to pay salaries, provide subsidies, or continue development programs. Without borrowing, many important services would stop.

Another major reason is development projects. Building highways, dams, hospitals, and schools requires huge amounts of money. Since governments cannot always collect enough revenue in a short time, they borrow funds to complete these projects. In this way, borrowing becomes an investment in the future, because better infrastructure leads to more trade, jobs, and economic growth.

Governments also borrow during emergencies. Wars, natural disasters, and pandemics create sudden financial needs. In such cases, borrowing allows the government to respond quickly without waiting for taxes or other revenues. Borrowing during emergencies protects citizens and keeps the economy stable.

Another reason for borrowing is debt servicing. Sometimes, governments borrow new money to pay back old loans. This is not ideal, but many countries use this method to avoid default. Similarly, governments borrow to stabilize the economy during recessions. Extra funds are spent to boost demand, create jobs, and prevent a financial slowdown.

In short, governments borrow not just because they lack money, but also because borrowing helps them plan, grow, and protect the economy. The key is to use borrowed money wisely so that it creates long-term benefits instead of adding to the debt burden.

Advantages of Government Borrowing

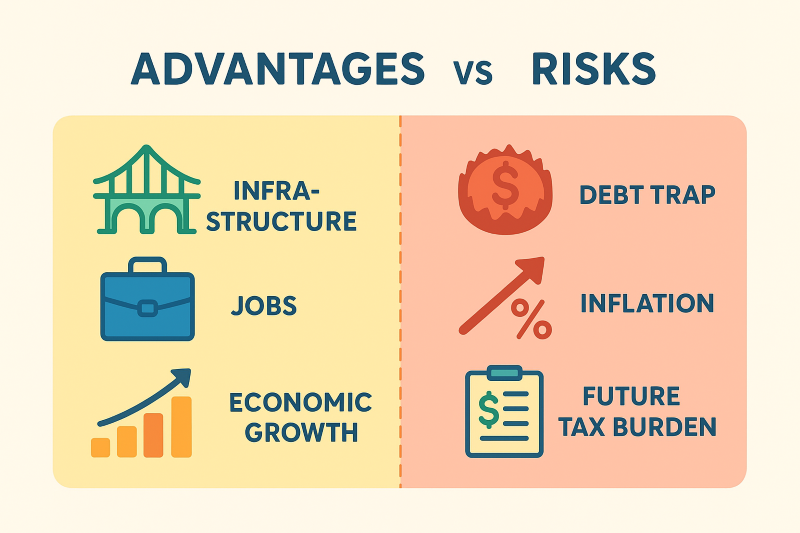

Government borrowing is often seen as a burden, but when it is managed wisely, it can bring many benefits to a country. Borrowing allows governments to fund projects, create opportunities, and protect the economy during difficult times. If loans are used productively, they can improve living standards and support long-term economic growth.

One major advantage is infrastructure development. Borrowed money is often used to build highways, dams, airports, power plants, schools, and hospitals. These projects create jobs, improve services, and support business activity. In the long run, strong infrastructure increases trade, attracts investment, and makes the economy more competitive.

Another benefit is employment creation. Development projects funded by borrowing give jobs to thousands of workers, engineers, and suppliers. These jobs increase household income, which boosts spending in the economy. As people spend more, businesses grow, and the economy expands further.

Government borrowing is also important for crisis management. During wars, natural disasters, or pandemics, immediate funds are needed. Borrowing allows governments to provide relief, rebuild damaged areas, and maintain stability. Without borrowing, many countries would struggle to respond to emergencies.

Borrowing also supports investor confidence. When governments issue bonds or treasury bills, citizens and institutions invest in them. This builds trust in the financial system and gives people a safe way to save money. At the same time, governments get funds for their needs.

Lastly, borrowing can stabilize the economy. In times of recession, when businesses are slow and unemployment is high, borrowed funds can be spent to boost demand. Governments can use these funds to finance public works, offer subsidies, or support industries, which helps the economy recover faster.

In short, government borrowing, when used for the right purposes, is not a weakness but a tool for progress. It builds infrastructure, creates jobs, manages crises, and strengthens the economy. The key is to borrow within limits and invest in areas that give future returns.

Risks and Challenges of Government Borrowing

While government borrowing has many advantages, it also carries serious risks. If borrowing is not managed carefully, it can create long-term problems for the economy and citizens. Many countries face financial crises not because they borrow, but because they borrow too much or spend borrowed money unwisely.

One of the biggest risks is the debt trap. This happens when a government keeps borrowing new money just to repay old loans. Instead of using funds for development, money goes into debt servicing. Over time, the debt grows so large that it becomes almost impossible to pay back without cutting essential services or raising taxes.

Another challenge is inflation. When governments borrow heavily from domestic sources, especially the central bank, more money enters the economy. This extra money can push up prices of goods and services. As inflation rises, the cost of living increases, and ordinary people suffer the most.

Dependence on foreign lenders is also a major risk. External borrowing may provide quick relief, but it often comes with conditions. Institutions like the IMF or World Bank may demand policy changes, spending cuts, or higher taxes in exchange for loans. These conditions can limit a country’s independence and affect the welfare of its citizens.

Government borrowing also puts pressure on the future generation. Loans taken today must be repaid tomorrow. This often means higher taxes, reduced public spending, or more sacrifices in the future. If current borrowing is wasted on unproductive projects, future citizens bear the burden without enjoying the benefits.

Another challenge is currency devaluation. When a country owes a large amount in foreign currency, demand for dollars or euros increases. This weakens the national currency, making imports more expensive. A weaker currency also makes it harder to repay external loans.

In short, government borrowing can become a double-edged sword. It helps in the short term but may harm the economy if misused. To avoid these risks, governments must borrow responsibly, invest in productive areas, and always plan for repayment.

Government Borrowing and Fiscal Policy

Government borrowing is closely linked to fiscal policy, which is the way a government manages its revenue, spending, and debt. Fiscal policy aims to keep the economy stable, promote growth, and provide public services. Borrowing becomes an important tool within this system, helping the government balance short-term needs with long-term goals.

When a government faces a budget deficit, borrowing allows it to continue spending on essential services like education, healthcare, and infrastructure. Without borrowing, the government would have to cut expenses sharply, which could slow down the economy and reduce citizen welfare. Borrowing gives flexibility to maintain services while planning for future revenue growth.

Responsible borrowing supports economic stability. For example, during a recession, the government can borrow money to finance public works or subsidies. This boosts demand, creates jobs, and helps the economy recover faster. At the same time, fiscal policy ensures that borrowed funds are used productively, not wasted on unnecessary expenses.

Fiscal policy also determines how much to borrow and from where. Governments need to maintain a balance between internal and external borrowing to avoid inflation, excessive foreign debt, or currency devaluation. Strong revenue collection through taxes and efficient public spending reduces the need for excessive borrowing. Transparent policies and careful debt management are essential for maintaining confidence among citizens and investors.

In summary, government borrowing is a key part of fiscal policy. When combined with smart planning and responsible spending, it can fund development, stabilize the economy, and support long-term growth. Mismanaged borrowing, however, can lead to debt crises, inflation, and financial instability. Therefore, fiscal discipline and careful debt planning are vital for every country.

Real-World Examples of Government Borrowing

Government borrowing is a common practice worldwide, and different countries use it in various ways depending on their economic needs. Understanding these examples helps us see how borrowing supports growth and manages financial challenges.

United States: The U.S. government regularly borrows money by issuing Treasury bonds and securities. These bonds are sold to investors, banks, and even other countries. Borrowing allows the U.S. to fund large projects, military expenses, and social programs like healthcare and social security. Even during economic slowdowns, borrowing helps stabilize the economy and maintain public services.

India: India uses a combination of internal and external borrowing. Domestically, the government raises funds by issuing bonds and borrowing from banks. Internationally, India borrows from institutions like the IMF and World Bank to fund infrastructure projects, energy initiatives, and social programs. Borrowing has helped India build highways, power plants, and educational institutions, boosting economic growth and employment opportunities.

Developing Countries: Many developing nations rely heavily on external loans to fund essential projects. For example, African countries often borrow from the World Bank or regional development banks to finance energy, healthcare, and transport projects. These loans provide resources that domestic revenue cannot cover. However, heavy external debt can create challenges like repayment pressure and dependency on foreign lenders.

Crisis Situations: Governments also borrow during emergencies. For instance, during the COVID-19 pandemic, many countries borrowed large amounts to support healthcare systems, provide relief packages, and stabilize the economy. Without borrowing, these countries would have struggled to respond quickly to the crisis.

These examples show that government borrowing is a practical tool for funding development, handling emergencies, and supporting economic stability. The key is using borrowed money wisely and ensuring that it creates long-term benefits for citizens.

Responsible Borrowing Practices

Government borrowing can be very helpful, but it must be done responsibly. Borrowing without a plan or for the wrong purposes can lead to debt crises, inflation, and financial instability. Responsible borrowing ensures that loans are used productively and that repayment is manageable.

First, governments should borrow for productive purposes. This means investing in infrastructure, education, healthcare, or energy projects that create long-term benefits. Borrowing for daily expenses or non-productive spending increases debt without improving the economy.

Second, governments need to maintain sustainable debt levels. This means the total debt should be manageable compared to the country’s GDP and revenue. Excessive borrowing may lead to a debt trap, where new loans are taken just to repay old ones. Monitoring debt-to-GDP ratios and repayment capacity is essential for stability.

Third, improving revenue collection reduces the need for excessive borrowing. Strong tax systems, better compliance, and efficient public revenue management allow governments to fund more projects from their income rather than loans.

Fourth, transparency and accountability are crucial. Citizens and investors should know how the borrowed funds are used. Clear reporting and proper audits prevent corruption, mismanagement, and wasteful spending.

Finally, governments should carefully plan repayment strategies. Borrowing should be timed with the country’s ability to generate revenue or repay through economic growth. Long-term planning avoids sudden repayment pressures that could harm the economy or require harsh austerity measures.

In short, responsible borrowing means borrowing for the right reasons, keeping debt sustainable, improving revenue, using funds transparently, and planning repayment carefully. This approach turns borrowing into a tool for growth rather than a financial burden.

Conclusion

Government borrowing is a key tool for modern economies. It helps countries cover budget deficits, fund development projects, create jobs, and manage emergencies. Borrowing is not inherently bad; it becomes a problem only when it is excessive, mismanaged, or used for unproductive purposes.

When governments borrow responsibly, the benefits are clear. Borrowed funds can improve infrastructure, support education and healthcare, and stimulate economic growth. Borrowing during crises allows governments to protect citizens and stabilize the economy. In addition, domestic borrowing builds trust among citizens and investors, while external borrowing brings much-needed resources for development.

However, risks also exist. Excessive borrowing can lead to a debt trap, inflation, dependency on foreign lenders, and pressure on future generations. Currency devaluation and high repayment obligations are additional challenges. That is why careful planning, transparency, and sustainable debt management are essential. Governments must ensure borrowed money is invested productively and repayment plans are realistic.

In summary, government borrowing is a powerful financial tool that, when managed well, drives growth and stability. It supports essential projects, creates opportunities, and helps nations respond to emergencies. The key to success lies in responsible borrowing, strong fiscal policies, and strategic planning. By borrowing wisely, governments can secure a stronger, more prosperous future for their citizens while avoiding the pitfalls of excessive debt.

Frequently Asked Questions

1. What is government borrowing?

Government borrowing is when a country takes money from domestic or foreign sources to cover expenses that exceed its revenue. It is also called public debt or national debt and helps fund development projects, emergencies, and economic stabilization.

2. Why do governments borrow money?

Governments borrow to cover budget deficits, finance infrastructure, support social programs, manage crises like pandemics or natural disasters, and sometimes repay old loans. Borrowing ensures the country can continue essential services even when revenue is insufficient.

3. What are the types of government borrowing?

There are two main types:

- Internal borrowing: Loans from domestic banks, institutions, or citizens through bonds.

- External borrowing: Loans from foreign governments, international banks, or institutions like the IMF and World Bank.

4. Is government borrowing good or bad?

Government borrowing is not inherently good or bad. It is good when used for productive purposes like development, infrastructure, and emergencies. It becomes harmful when excessive, mismanaged, or used for non-productive spending, which can lead to a debt trap or economic instability.

5. How does government borrowing affect citizens?

Borrowing affects citizens in both positive and negative ways. Productive borrowing can create jobs, improve infrastructure, and boost the economy. Excessive borrowing can lead to higher taxes, inflation, and reduced public spending in the future.

6. How can governments borrow responsibly?

Responsible borrowing involves:

- Using funds for productive projects.

- Keeping debt at sustainable levels compared to GDP.

- Improving revenue collection to reduce reliance on loans.

- Maintaining transparency and accountability.

- Planning realistic repayment strategies to avoid financial stress.