The Winter Fuel Payment has become one of the most important forms of financial assistance for pensioners in the United Kingdom. Each year, as the colder months approach, energy bills rise sharply, leaving many older people worried about how they will afford to heat their homes. For those living on a fixed income, particularly individuals who rely solely on their state pension, this extra expense can cause significant stress and hardship. The Winter Fuel Payment was introduced to ease this burden, giving pensioners additional support so they can keep their homes warm without having to make difficult choices between heating, food, and other essentials.

Winter can be a particularly challenging season for older adults. Cold weather is not just uncomfortable; it can also have serious health consequences. Conditions like arthritis, respiratory illness, and heart disease are all made worse by living in low temperatures. For this reason, the government designed the Winter Fuel Payment not only as a financial measure but also as a public health initiative, ensuring that pensioners can maintain a safe and warm living environment. It is a lifeline that promotes both comfort and well-being during the harshest time of the year.

Over the years, the payment has become a well-recognized and much-anticipated benefit. While it may not cover the entirety of rising energy bills, it does provide meaningful relief to millions of pensioners across the country. It is tax-free, simple to receive, and designed to reach those most in need automatically. At its core, the Winter Fuel Payment reflects the government’s responsibility to support its older population and ensure that no pensioner has to endure the winter months in the cold.

What is the Winter Fuel Payment?

The Winter Fuel Payment is a government-funded, tax-free benefit provided to older people in the United Kingdom to help with the additional costs of heating their homes during the coldest months of the year. Unlike many other social security payments, it is not based on income or savings, which means it is available to a wide range of pensioners regardless of their financial circumstances. The payment is usually made once a year, automatically deposited into the pensioner’s bank account, generally between November and December. Its main aim is to ease the pressure of high energy bills, which can be especially difficult for people who rely on a fixed income.

This payment was first introduced in the late 1990s as part of a broader effort to reduce fuel poverty among older people. Fuel poverty refers to situations where households are unable to afford to keep their homes adequately warm, leading to both discomfort and serious health risks. For pensioners, who often spend more time at home than younger people, heating becomes even more essential. The Winter Fuel Payment was designed to act as a safety net, helping ensure that no pensioner is left without adequate warmth during the harsh winter months.

One of the most notable features of the Winter Fuel Payment is its universality within the eligible age group. Whether someone receives only the State Pension or has additional income from savings or private pensions, they are still entitled to this support. This makes the scheme straightforward and reduces the stigma that can sometimes be associated with means-tested benefits. In addition, it simplifies the process by eliminating complicated financial assessments, meaning that most pensioners receive the payment automatically without needing to apply.

The amount received depends on factors such as age and household circumstances. Typically, the payment ranges between £100 and £300 per year, with higher amounts awarded to those aged 80 and over. The money is not ring-fenced, which means pensioners can use it for any purpose, although it is primarily intended to support heating costs. This flexibility allows individuals to manage their household expenses in a way that suits them best, whether that means paying energy bills directly, covering additional winter-related costs, or saving the money for later use during particularly cold spells.

In essence, the Winter Fuel Payment is not just a financial benefit—it is a recognition of the challenges pensioners face during winter. It provides peace of mind, knowing that some of the burden of heating costs will be lifted, and it helps older people maintain both their health and dignity in colder weather.

Who Qualifies for the Winter Fuel Payment?

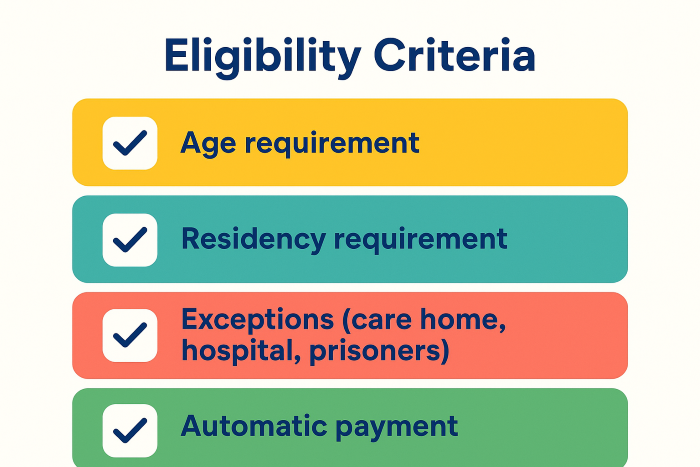

Not every person in the UK is entitled to receive the Winter Fuel Payment. The scheme is designed specifically for older people, primarily those who have reached the qualifying age linked to the State Pension. Eligibility is based on a combination of age, residency, and certain other personal circumstances. Understanding who qualifies is important so pensioners know whether they will receive the payment automatically or if they need to make a claim.

Age Requirement

The most basic rule for eligibility is age. To qualify for the Winter Fuel Payment, you must have been born on or before a set date determined by the government each year. For example, for the winter of 2023–24, people born on or before 25 September 1957 qualified for the payment. This date changes annually, but the principle remains the same: the payment is targeted at people of pension age. Generally, if you are 66 years old or above (the current State Pension age), you are likely to qualify.

Residency Requirement

In addition to age, residency is another key condition. To be eligible, you must have lived in the United Kingdom for at least one day during the government’s official qualifying week (usually a week in late September). This rule ensures that the payment is directed toward those who genuinely face UK winter conditions.

For certain pensioners living abroad, there are exceptions. People living in some European Economic Area (EEA) countries or Switzerland may still be able to claim the Winter Fuel Payment, provided they meet the age requirement and have a sufficient connection to the UK, such as having lived or worked there previously. However, those living in warmer countries, like Spain or Portugal, where average winter temperatures are higher, generally do not qualify.

Exceptions and Exclusions

Although the Winter Fuel Payment covers a large portion of the pensioner population, there are some situations where individuals will not be eligible:

- Long-term hospital patients: Pensioners who have been in hospital receiving free treatment for more than 52 weeks are not eligible.

- Care home residents: Those living in care homes and receiving Pension Credit, Income Support, or income-based Jobseeker’s Allowance may not qualify for a payment.

- Prisoners: People serving prison sentences are excluded from the scheme.

- Non-residents: Those who do not meet the UK residency requirement, unless they qualify under special EEA rules, are not eligible.

Automatic vs. Manual Claims

In most cases, pensioners who receive the State Pension or other qualifying benefits (such as Pension Credit) will get the Winter Fuel Payment automatically. This means they do not need to apply—the government simply sends the payment directly to their bank account.

However, some pensioners may need to make a claim. This is usually the case for those who have not claimed a State Pension or certain benefits before, or for people who live abroad in eligible countries. The claim process is simple, involving either a phone call to the Winter Fuel Payment helpline or completing a claim form.

The eligibility rules show that while the Winter Fuel Payment is widely available, it is carefully structured to reach those who truly need help with heating costs during winter. The system balances inclusivity with safeguards against misuse, ensuring that support goes directly to the older generation facing the realities of cold weather.

How Much Do Pensioners Get?

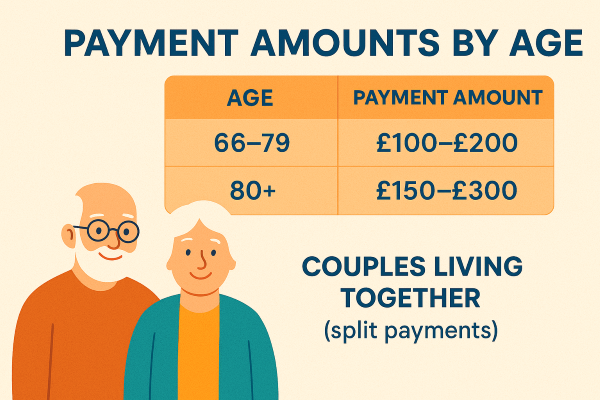

The amount of Winter Fuel Payment a pensioner receives is not the same for everyone—it varies depending on age and living arrangements. While the payment is designed to be straightforward and inclusive, the government has introduced different levels to reflect the additional needs of the very elderly and to account for situations where multiple people in one household might qualify. The payment usually falls between £100 and £300 per year, and this sum is provided as a single, tax-free lump sum directly into the pensioner’s bank account during the winter season.

Standard Amounts

The standard Winter Fuel Payment is divided based on age brackets:

- Aged 66 to 79: Pensioners in this age group usually receive between £100 and £200.

- Aged 80 or over: Pensioners in this older group are entitled to a higher payment, usually between £150 and £300.

The reason for the higher amount for those aged 80 and above is clear—older pensioners tend to be more vulnerable to cold weather, spend more time indoors, and may face higher energy use to stay warm. The government recognizes this and ensures they receive additional support.

Living Alone or With Others

Another factor that affects the payment is whether the pensioner lives alone or with other qualifying individuals. If you live alone and meet the age requirement, you’ll typically receive the full amount. However, if you live with another person who also qualifies for the Winter Fuel Payment, the amount may be split between you.

For example:

- Two pensioners living together, both under 80, would usually get £100 each instead of £200 each.

- If one pensioner is over 80, they may receive a higher portion (e.g., £150), while the other receives the standard share.

This system prevents households with multiple eligible pensioners from receiving duplicated full payments, while still ensuring each person gets their fair share.

Living in a Care Home

For pensioners living in care homes, the rules are slightly different. If you are in a care home and do not receive benefits such as Pension Credit, you may still qualify, but the amount is often lower than the full payment. If you are in a care home and receive Pension Credit, however, you may not qualify at all. This ensures that government support is distributed fairly and avoids overlap with other forms of financial assistance.

Example Scenarios

To make the rules clearer, here are some simple examples:

- A 70-year-old pensioner living alone could receive £200.

- A couple, both aged 70, living together could receive £100 each.

- An 85-year-old living alone could receive £300.

- A couple, one aged 70 and the other aged 82, might receive £200 in total, split according to their ages.

Payment is Flexible

Importantly, the Winter Fuel Payment is not ring-fenced—there are no restrictions on how the money can be spent. While it is primarily intended for heating costs, pensioners are free to use it however they see fit. For many, this flexibility is a great advantage, as it allows them to manage their finances in the way that best meets their household needs.

In summary, while the Winter Fuel Payment amount varies depending on age and living circumstances, it always aims to provide meaningful support to pensioners. Whether it’s £100 or £300, this financial boost can make a significant difference during winter, easing the burden of high energy bills and ensuring older people can stay warm and healthy.

How is the Winter Fuel Payment Made?

The process of receiving the Winter Fuel Payment has been designed to be as simple and stress-free as possible for pensioners. Since this benefit is meant to provide comfort and relief during the coldest months of the year, the government ensures that most eligible people receive the payment automatically without needing to make repeated applications. The system prioritizes efficiency, so that pensioners can focus on keeping warm rather than worrying about complicated paperwork.

Automatic Payments

For the majority of pensioners, the Winter Fuel Payment is made automatically. If you already receive the State Pension or certain other social security benefits—such as Pension Credit, Income Support, or income-related Employment and Support Allowance (ESA)—you are usually enrolled into the scheme without needing to apply. In these cases, the Department for Work and Pensions (DWP) identifies who qualifies and arranges the payment directly.

The money is paid directly into your bank account, usually using the same account details linked to your State Pension or benefits. This avoids unnecessary delays and ensures pensioners do not have to manage separate accounts or complicated financial processes.

Payment Period

The payment is typically sent out between November and December, just as the weather begins to get colder and households start relying more heavily on heating. The aim is to ensure pensioners have the money available when they need it most—before the peak of winter energy costs. In some cases, payments may arrive in January, but the vast majority are completed by the end of December.

Payment Reference

When the money is deposited, it will appear on your bank statement with a payment reference such as “DWP WFP” (Department for Work and Pensions Winter Fuel Payment). This makes it easy to identify and confirm that you have received your entitlement.

Applying for the Payment

Not everyone receives the payment automatically. Some pensioners may need to make a claim, especially if:

- They have not previously received the State Pension or qualifying benefits.

- They live abroad in certain eligible European countries or Switzerland.

- Their personal circumstances have recently changed (for example, moving to the UK or reaching pension age but not yet claiming a pension).

In these cases, pensioners can apply by:

- Calling the Winter Fuel Payment helpline (a dedicated service provided by the DWP).

- Filling out a claim form, which can usually be downloaded online or requested by post.

Applications often require basic personal details such as your National Insurance number, bank account details, and proof of residency during the qualifying week in September.

Claim Deadlines

There is a strict deadline for claims. Pensioners who need to apply must usually do so by the end of March following the winter season. For example, for the winter of 2023–24, the deadline to submit a claim is 31 March 2024. Missing this deadline could mean losing out on the payment for that year, so it is crucial for pensioners to apply in time if they do not receive it automatically.

Special Cases

There are also certain situations where payments may be delayed or adjusted:

- Care home residents may receive reduced amounts or be excluded if they are already receiving benefits like Pension Credit.

- Pensioners living abroad may face different rules depending on their country of residence.

- If a pensioner has recently moved or changed bank accounts, they should notify the DWP to avoid delays in receiving their payment.

In essence, the process of receiving the Winter Fuel Payment is designed to be straightforward, with most pensioners receiving it automatically without lifting a finger. For those who need to apply, the system remains simple and accessible. By making the payment in the early part of winter, the government ensures that pensioners have the financial support they need to manage their heating bills and keep their homes warm when it matters most.

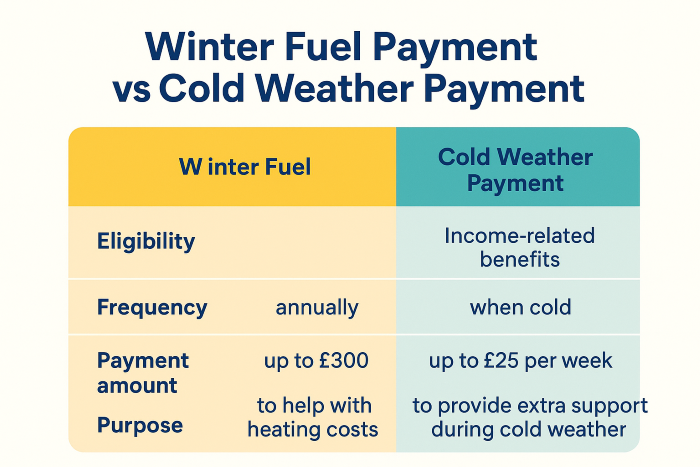

Difference Between Winter Fuel Payment and Cold Weather Payment

Many people confuse the Winter Fuel Payment with the Cold Weather Payment, but in reality, they are two very different schemes. While both are designed to help people cope with higher heating costs, they operate under separate rules, target different groups, and are paid out in distinct ways. Understanding the difference is essential, especially for pensioners who might be entitled to one, both, or neither of these payments.

Winter Fuel Payment: A Seasonal Lump Sum

The Winter Fuel Payment is a once-a-year, tax-free lump sum that is automatically given to most pensioners who meet the age and residency criteria. The amount ranges from £100 to £300 depending on age and circumstances, and it is paid regardless of how cold the weather actually gets. Its purpose is to give older people the financial flexibility to manage their heating costs during the entire winter season.

Key features of Winter Fuel Payment:

- Paid annually, usually between November and December.

- Based on age and residency, not income.

- Amount ranges between £100 and £300.

- Aimed specifically at people of State Pension age or older.

Cold Weather Payment: Triggered by Freezing Conditions

In contrast, the Cold Weather Payment is a means-tested benefit linked directly to actual weather conditions. It is available to people on certain income-related benefits, such as Pension Credit, Income Support, Jobseeker’s Allowance, Employment and Support Allowance, or Universal Credit. The payment is only made when the temperature in your local area drops to, or is forecast to drop to, zero degrees Celsius or below for seven consecutive days.

For each qualifying period of cold weather, eligible individuals receive £25 per week. The payments are made automatically and continue throughout the winter season whenever the temperature condition is met. Unlike the Winter Fuel Payment, the Cold Weather Payment is not exclusive to pensioners—anyone receiving the right benefits may qualify.

Key features of Cold Weather Payment:

- Paid when weather conditions reach freezing temperatures.

- Amount is £25 per qualifying week.

- Means-tested, based on specific benefits being claimed.

- Available to a broader group, including some pensioners and low-income families.

Key Differences Summarised

- Eligibility: Winter Fuel Payment is based on age; Cold Weather Payment is based on income-related benefits and weather conditions.

- Frequency: Winter Fuel Payment is a one-off annual lump sum; Cold Weather Payment is made multiple times if freezing weather occurs.

- Amount: Winter Fuel Payment ranges between £100–£300; Cold Weather Payment is fixed at £25 per week of severe cold.

- Purpose: Winter Fuel Payment supports pensioners throughout winter; Cold Weather Payment responds to specific cold spells for those in financial need.

In short, the Winter Fuel Payment is a seasonal allowance for older people, while the Cold Weather Payment is a weather-dependent safety net for vulnerable households on low incomes. Both are valuable, but they are distinct in their scope, eligibility, and payment structure. Pensioners should be aware that they may qualify for one or both, depending on their age, income, and circumstances.

Why is the Winter Fuel Payment Important?

The Winter Fuel Payment is more than just a financial allowance—it plays a crucial role in ensuring the health, comfort, and well-being of older people during the coldest months of the year. As energy costs rise and winters can be harsh, this payment provides pensioners with much-needed support to maintain a warm and safe home environment. Its importance extends beyond mere financial relief, touching on aspects of public health, social equity, and quality of life.

Protecting Health and Well-being

Cold weather can be dangerous, particularly for older adults. Exposure to low temperatures increases the risk of serious health issues, including respiratory infections, hypothermia, strokes, and heart attacks. For those with pre-existing medical conditions, such as arthritis or chronic lung problems, staying warm is essential to avoid worsening symptoms. By providing a lump sum specifically to help cover heating costs, the Winter Fuel Payment helps prevent these health risks and enables pensioners to live more comfortably indoors.

Beyond physical health, warmth contributes to mental well-being. Cold, damp homes can lead to stress, anxiety, and feelings of isolation. Many pensioners spend more time at home, especially during winter months, and insufficient heating can make their living spaces uncomfortable and even unsafe. The payment allows them to keep their homes warm, creating a sense of security and reducing winter-related stress.

Reducing Fuel Poverty

Fuel poverty is a significant problem in the UK, affecting many older households with limited income. Fuel poverty occurs when households cannot afford to heat their homes adequately, forcing difficult choices between energy, food, and other essentials. The Winter Fuel Payment provides direct financial support to ease this burden. It acts as a buffer against rising energy costs and ensures that older people do not have to compromise on basic living standards just to stay warm.

Supporting Financial Independence

Another key aspect of the Winter Fuel Payment is its flexibility. The money is tax-free and not means-tested, giving pensioners the autonomy to decide how to use it. While the payment is intended for heating costs, recipients can allocate it according to their individual household needs, whether that means paying energy bills, covering other winter-related expenses, or saving it for later. This autonomy reinforces a sense of independence and dignity, which is particularly important for older adults who may already face challenges in managing their finances.

Social and Governmental Significance

From a broader perspective, the Winter Fuel Payment reflects the government’s commitment to supporting the older population. It acknowledges that pensioners face unique challenges during winter and that proactive financial assistance can prevent health emergencies, reduce strain on healthcare services, and improve overall quality of life. By helping older people stay warm and healthy, the scheme benefits society as a whole, not just the individuals who receive it.

In conclusion, the Winter Fuel Payment is far more than a simple cash benefit. It is a lifeline that promotes safety, health, and dignity during the winter months, allowing pensioners to live comfortably and independently. Its role in reducing fuel poverty, protecting health, and supporting financial autonomy makes it an essential component of the social safety net for older adults in the UK.

Recent Changes and Updates to the Winter Fuel Payment

The Winter Fuel Payment has undergone significant changes in recent years, particularly concerning eligibility criteria and payment recovery. These adjustments have sparked debate and concern among pensioners and advocacy groups. Understanding these changes is crucial for pensioners to navigate the current system and ensure they receive the support they are entitled to.

Eligibility Adjustments: From Universal to Means-Tested

Historically, the Winter Fuel Payment was a universal benefit available to all pensioners, regardless of income. However, in July 2024, the UK government announced a shift towards a means-tested approach. From the 2024/2025 winter, the payment was restricted to pensioners receiving Pension Credit or certain other means-tested benefits, effectively excluding millions of pensioners with higher incomes from receiving the payment

This policy change led to widespread criticism. Former Pensions Minister Sir Steve Webb argued that the policy unfairly penalized pensioners whose incomes had risen due to inflation-linked increases in state and private pensions, pushing them over the £35,000 eligibility threshold

Reversal and Restoration of Universal Eligibility

In response to public outcry and political pressure, the government reversed this decision in June 2025. Chancellor Rachel Reeves announced that, starting from the 2025/2026 winter, the Winter Fuel Payment would be reinstated for all pensioners earning £35,000 or less annually. This change restored the payment to approximately 9 million pensioners in England and Wales, aiming to alleviate fuel poverty and support older individuals during the winter months

Recovery Mechanism for Higher Earners

While the payment has been reinstated for most pensioners, those with annual incomes exceeding £35,000 will receive the payment but are required to repay it through the tax system. This recovery mechanism will be implemented via HM Revenue and Customs (HMRC), ensuring that higher earners contribute back to the fund

Impact on Pensioners and Future Outlook

These changes have had a significant impact on pensioners. The initial restriction to means-tested benefits left many without support, while the subsequent reinstatement has provided relief to a broader group. However, the recovery process for higher earners introduces new complexities that pensioners need to be aware of.

Looking ahead, it’s essential for pensioners to stay informed about any further changes to the Winter Fuel Payment. Regularly checking official government communications and consulting with financial advisors can help ensure that they continue to receive the support they are entitled to.

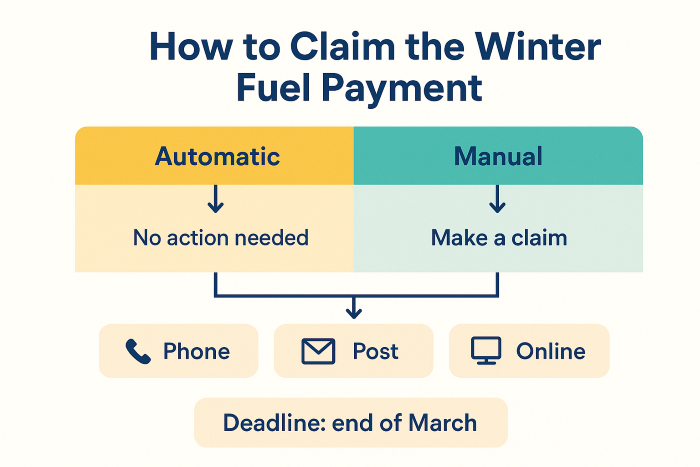

How to Claim the Winter Fuel Payment

Claiming the Winter Fuel Payment is generally a straightforward process, especially for those who receive the State Pension or other qualifying benefits. For most pensioners, the payment is automatic, meaning they do not need to take any action to receive it. However, there are circumstances where a claim must be made manually, and understanding the correct process ensures pensioners do not miss out on this important support.

Automatic Payments

If you already receive the State Pension or certain other social security benefits, such as Pension Credit, Income Support, or income-related Employment and Support Allowance (ESA), the Department for Work and Pensions (DWP) usually makes the Winter Fuel Payment automatically. This system eliminates the need for pensioners to complete forms or submit applications each year. The payment is typically deposited directly into the same bank account used for your benefits, usually between November and December.

Who Needs to Make a Claim

Some pensioners, however, may need to apply for the payment. This applies to individuals who:

- Have reached State Pension age but do not receive a qualifying benefit.

- Live abroad in certain European Economic Area (EEA) countries or Switzerland.

- Recently moved to the UK or have had a change in circumstances that affects eligibility.

In these cases, making a claim is essential to receive the payment.

How to Make a Claim

The process for claiming the Winter Fuel Payment is simple and accessible:

- By phone: Pensioners can call the dedicated Winter Fuel Payment helpline provided by the DWP. The helpline staff can guide applicants through the process and answer any questions.

- By post or online: A claim form can be downloaded from the official government website, completed, and returned by post. Some pensioners may also be able to submit their claim online, depending on their country of residence.

When making a claim, pensioners will typically need to provide the following information:

- Full name and date of birth

- National Insurance number

- Bank or building society details for payment

- Residency information for the qualifying week in September

Deadlines for Claims

There is a strict claim deadline that pensioners must be aware of. Applications for the Winter Fuel Payment usually need to be submitted by the end of March following the winter season. For example, for the 2023–24 winter, the deadline was 31 March 2024. Missing this deadline may result in losing the payment for that year.

Special Considerations

- Changes in circumstances: If a pensioner moves house, changes bank accounts, or starts receiving qualifying benefits mid-year, they should notify the DWP to ensure they receive the payment.

- Care home residents: Pensioners living in care homes may have different rules depending on other benefits received. It’s important to check eligibility in these cases.

- Living abroad: Pensioners residing overseas must ensure they meet the residency requirements and submit the necessary claim forms.

In summary, claiming the Winter Fuel Payment is simple for most pensioners, as it is automatically paid to those already receiving qualifying benefits. For those who need to make a manual claim, following the correct procedure ensures they receive this vital support on time, helping them cover heating costs and maintain comfort during the cold winter months.

Conclusion

The Winter Fuel Payment stands as a vital support system for pensioners across the United Kingdom, providing both financial relief and peace of mind during the coldest months of the year. Its significance goes beyond the simple monetary value—it represents a commitment to ensuring that older people can maintain a safe, warm, and comfortable living environment without facing the difficult choice between heating and other essential expenses.

Over the years, the scheme has evolved to meet the changing needs of pensioners. From automatic payments to adjustments in eligibility and recent updates, the government has continually sought to balance fairness, efficiency, and accessibility. Despite these changes, the core purpose remains unchanged: to protect older adults from the risks associated with cold weather, reduce fuel poverty, and enhance overall well-being.

For pensioners, the Winter Fuel Payment is more than just a lump sum; it is a tool for independence and security. It allows recipients to manage their household expenses with greater flexibility, maintain their health during harsh winters, and enjoy a sense of dignity and autonomy in managing their finances. The scheme also underscores a broader social principle—society has a responsibility to support its older population, especially in times of increased vulnerability.

Ultimately, the Winter Fuel Payment is a lifeline. It not only helps pensioners stay warm but also contributes to their physical health, mental well-being, and financial stability. For anyone of pension age, understanding eligibility, payment processes, and recent updates ensures that they can make the most of this essential benefit. In a season where warmth and comfort are critical, the Winter Fuel Payment remains an indispensable part of the support system for older people in the UK.

Frequently Asked Questions

1. Who is eligible for the Winter Fuel Payment?

Pensioners who have reached the State Pension age and meet the UK residency requirement are generally eligible. Most people who receive the State Pension or certain benefits (like Pension Credit) get the payment automatically. Some pensioners living abroad may also qualify under special rules.

2. How much money can I receive from the Winter Fuel Payment?

The amount depends on age and household circumstances:

- Aged 66–79: Typically £100–£200

- Aged 80 or over: Up to £300

Couples living together may have payments split based on individual ages.

3. Do I need to apply for the Winter Fuel Payment?

Most pensioners receive it automatically if they get the State Pension or qualifying benefits. You only need to apply manually if you do not receive these benefits, live abroad in an eligible country, or have recently reached pension age.

4. Can I use the Winter Fuel Payment for anything I want?

Yes. The payment is tax-free and flexible, meaning it is not restricted to heating costs. Pensioners can use it for energy bills, winter essentials, or save it for later.

5. What is the difference between Winter Fuel Payment and Cold Weather Payment?

The Winter Fuel Payment is an annual lump sum for pensioners, based on age and residency, while the Cold Weather Payment is means-tested, paid in £25 weekly increments during periods of freezing weather, and can be claimed by low-income households, not just pensioners.

6. When is the Winter Fuel Payment made?

Payments are usually made automatically between November and December. If you need to make a claim manually, it should be submitted by the end of March following the winter season.

1 Comment

Pingback: HMRC Tax Bank Accounts: Complete UK Compliance Guide